Manifesto:

Stable Currency,

Global Access

Kontigo is building a self-driving, stable-currency platform to close financial gaps for billions.

Intro

Why Stable-currency? Why not “stablecoins”?

We define stable-currency as value not solely dependent on a single volatile, inflationary or centralized asset—achieved by composing decentralized reserves (BTC), diversified stable rails (USDC/local stables), and agentic routing that mitigates any single issuer/jurisdiction risk.

Stablecoins are an important milestone—not the destination. We’re engineering a durable, inflation-resilient unit for everyday life, grounded in decentralized primitives and rigorous execution.

Why Self-driving?

Traditional financial markets are fragmented, outdated, and inefficient. We run autonomous agents in our backend that continuously find the best rates, routes, and rails to transact locally and globally—so users don’t have to micromanage expensive FX, liquidity, or compliance contexts.

We use self-driving and agenticinterchangeably: autonomous services that execute routing, FX, and policy on the user’s behalf.

The Basics

Even the most basic building blocks of a dignified life—water, food, education, connectivity—remain unevenly distributed. As a result, human, social, and financial progress is still largely determined by the latitude and circumstances of one’s birth. Passports and currencies cap opportunity.

What We Believe In

1. Financial empowerment unlocks human potential. With the right technologies and opportunities, anyone can generate growth, close gaps, and advance society—regardless of context.

2. Technology is the decisive catalyst. It dismantles barriers faster than policy alone.

3. Decentralized finance restores agency. By removing gatekeepers, it puts prosperity’s levers directly in people’s hands.

4. Excellence and greatness are universal possibilities—if the right technology is within reach.

5. If talent is evenly distributed, opportunities must be too.

6. Unchecked social and financial inequality becomes an extremely dangerous fuel in a future of super-intelligence, humanoid robots, and brain–computer interfaces.

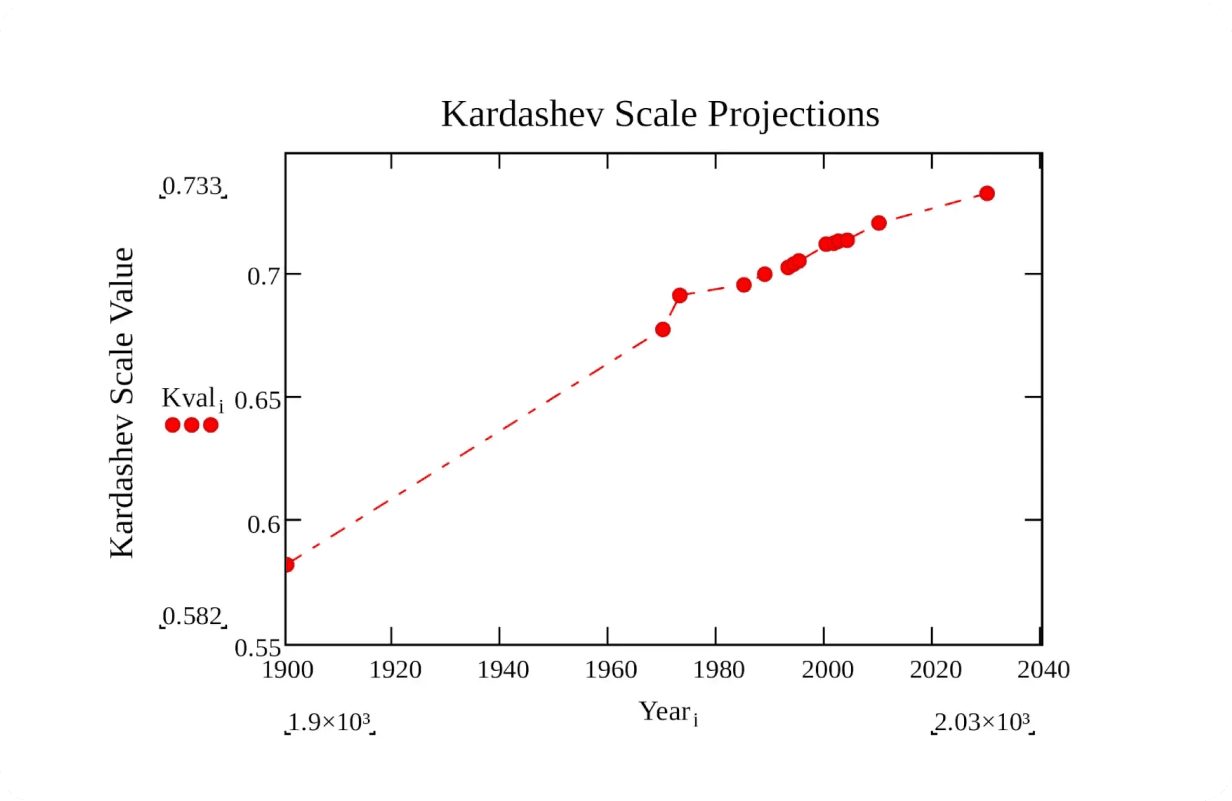

7. To accelerate humanity’s climb on the Kardashev scale, we must erase the financial divide that still traps billions in poverty.

What We Stand For

Equality of input, not equality of output. We fight for fair entry points, not uniform endpoints.

We are obsessed with craftsmanship & perfection as the surest path to excellence.

You can build a society that aims for greatness by giving everyone equal access to opportunity.

Aspirational by design. We pursue greatness itself, not the ornament of social status.

Greatness is class-agnostic. It may look like Steve Jobs; it may look like Bitcoin. Newton. Bonaparte. Marie Curie. Einstein. Jensen Huang. Da Vinci.

What Drives Us

We grew up in scarcity. Our founding team comes from Argentina, Venezuela, Bolivia, Colombia, Brazil, and Mexico—countries that have endured repeated inflation shocks and currency failures, with hundreds of millions of people still under-served by formal finance. Many of our families and friends remain trapped in the same cycle. We are determined to help break it at scale.

Where We Started

We focused first on regions with the largest adoption incentive. While stablecoin innovation gets attention in the U.S. and other developed markets, the multi-trillion-dollar on-chain settlement wave is compounding where currency instability and cross-border friction are highest.

How It Converged

Paradoxically, our paths didn’t converge in LatAm—they converged in the so-called “ground zero,” San Francisco. We were gravitationally pulled by the Bay Area’s ambition and diversity. Here, we met and founded Kontigo.

Where We Are Headed

By 2035, our goal is to ensure that anyone, anywhere can access a global, permissionless, decentralized credit-and-debit account—denominated in stable currency and linked to their phone number.

How We Will Get There

By going back to fundamentals: a peer-to-peer electronic stable-cash system

After Satoshi published the Bitcoin whitepaper in 2008, the ecosystem exploded in scope—from Ethereum to Solana, from stablecoins to the Lightning Network, from multi-party computation (MPC) to zero-knowledge (ZK)—and, yes, from breakthroughs to failures like FTX and Terra. Yet nearly seventeen years later, we still lack a Bitcoin-native, everyday cash system that is decentralized, permissionless, and stable at the same time.

Some argue Bitcoin was not designed to be price-stable in the near term. Whether or not that premise is true, today Bitcoin is not a practical unit of account for everyday life.

Stablecoins are an essential milestone toward mainstream crypto use, but not sufficient to close financial gaps on their own: most carry issuer and jurisdiction risk, and they fragment across rails and regions. The Lightning Network solves important throughput and settlement problems, but spending a potentially appreciating asset on small purchases faces opportunity-cost dynamics (Gresham’s law)—which limits routine spend.

The deeper challenge is meeting, simultaneously, the three classical functions of money: store of value, medium of exchange, and unit of account. Bitcoin excels as a store of value and can function as a medium of exchange in many contexts, but it is not yet a practical unit of account. A chicken-and-egg loop emerges:

- To dampen volatility, Bitcoin needs everyday transactional use.

- To achieve that use, it must first behave like a unit of account.

Volatility may compress over time as adoption deepens and issuance completes around 2140, but the world cannot wait for that. Roughly 1.4 billion people remain unbanked, and billions more are under-served in fragile, inflationary economies.

Our conviction: blend Bitcoin’s store-of-value properties with stable-denominated rails as the unit of account and medium of exchange, then apply agentic routing and ZK-secured P2P to remove adoption and stability asymmetries. The core technologies exist; what remains is disciplined engineering and distribution.

That’s where Kontigo steps in.

What Kontigo Is Not

Not another vanity token, protocol, blockchain, or L2. We have enough of those.

So what’s Kontigo?

A stable-currency platform. More precisely: a self-custodial wallet that stores value in Bitcoin and spends in local stablecoins, with agentic routing beneath a radically simple UX.

1. Issues debit and credit cards tied to self-custody.

2. Provides a ZK-secured, decentralized P2P layer for instant settlement.

3. Uses existing stablecoin–fiat liquidity rails for global reach.

4. Operates globally through local stablecoins for users and merchants.

5. Extends on-chain credit, initially collateralized by Bitcoin.

6. Exposes public APIs for checkout buttons, payment links, and embedded wallets.

7. Delivers 100% crypto abstraction—my mother, your uncle, anyone can use it.

8. Remains decentralized at the core, stability at the edge—non-speculative by design.

Our Internal “Kardashev” Scale: a realistic path to UBI (opportunity at scale)

Phase I — Smart Self-Custody Wallet Infrastructure (Current Position)

Wallet & identity. We generate MPC-abstracted BTC & ERC-20 wallets for every user. For mainstream onboarding, we bind the wallet to a phone number using privacy-preserving proofs (e.g., zkTLS-style attestations) so the phone can act as a key without revealing PII or giving intermediaries the ability to read, alter, or suspend the account.

Hold BTC, spend local. Any individual, merchant, or enterprise can hold Bitcoin (reserve) and transact using their local stablecoin (unit of account / medium of exchange).

Global movement + local spend. Users move funds globally and spend locally; builders can compose on top of our open interfaces.

Inflation hedge. Holding BTC and transacting in a stable unit provides practical protection against local-currency inflation.

Smart routing (agents). Our agentic system computes best rates, routes, and rails across corridors and counterparties. We prefer on-chain FX where it’s cheaper/faster, using our “stablecoin sundae” method—stacked hops that minimize slippage, fees, and liquidity risk.

On/Off-ramps. We integrate bank, card, and fintech ramps with dynamic policy-aware routing. The system quotes viable paths and executes the best route under risk/compliance constraints.

Liquidity scaling. We scale liquidity using our decentralized, on-chain, ZK-abstracted P2P marketplace alongside local-stablecoin liquidity pools.

Live flows. Our current platform already employs zk proofs and decentralized P2P for flows such as Zelle ↔ USDC. The next milestone is a fully on-chain P2P marketplace—no intermediaries, global liquidity.

Savings & wealth tools.

USDT Piggy Banks (goal-based DCA with optional timelocks),

USDC Rotating Savings Pools (ROSCAs) with on-chain transparency,

BTC global 401k long-term (“retirement-style”) plans,

Third-Way Card Network (foundation). As autonomous agents handle a growing share of payments, legacy card networks show structural inefficiencies. We are constructing an on-chain settlement layer that is faster, cheaper, and incentive-aligned:

Interchange shifts from merchant-funded fees to protocol-driven rewards.

Cashback accrues on-chain, redeemable across the ecosystem.

Non-custodial debit rails spend directly from self-custody via compliant controls.

Distribution engine. By binding wallets to phone numbers in WhatsApp we enable local distribution at global scale; autonomous agents compress the learning curve to near zero.

Security & continuity. Zero-knowledge cryptography, MPC, and Bitcoin’s settlement assurances underpin privacy, safety, and durability.

Compliance stance. All features are jurisdiction-aware. Yield, cards, P2P, and FX follow local licensing and partner-program constraints; the UX adapts policy at runtime.

Phase I outcome: a production-grade, agent-routed stable-currency payments + savings stack where BTC is the reserve and local stablecoins are the daily spend rails—abstracted enough for anyone to use.

Phase II — Kontigo Koin (K): native rewards and supply balancing

As our stable-currency infrastructure scales to millions of users and thousands of businesses, a native reward system is required to distribute, balance, and scale the value created in the ecosystem.

Market asymmetry. In high-inflation markets, nearly everyone wants to buy USD/USDC/USDT; few will sell for local fiat. Demand persistently exceeds supply by meaningful multiples.

USDK (k). We address this by introducing USDK, a local-stability instrument designed to absorb inflationary currency supply—a converter that reliably turns local fiat into a stable on-ramp and back.

Transparent rules for issuance/redemption.

Backing and market-making via licensed partners/structures.

Programmatic incentives to deepen local liquidity pools precisely where supply is thin.

Koin (K).

Earned for actions that increase network health: payments volume, merchant acceptance, providing corridor liquidity, verified proofs, dispute resolution in P2P, etc.

Spent/sunk on network fees, priority routing, dispute bonds, merchant promos.

Framed as usage-based rewards, not as promissory yield.

Combined effect (K + k).

Rewards pull liquidity into thin markets, while USDK and local stablecoins stabilize spendability.

Users accumulate portable, on-chain participation stakes aligned with network health.

Phase II outcome: a self-reinforcing liquidity/rewards flywheel that deepens acceptance, tightens spreads, and stabilizes local spend—without creating a speculative circus.

Phase III — Universal Credit Access

Credit is structural to modern economies, yet traditional models depend on historical data the under-served often lack.

Signals we unlock. Phases I–II produce privacy-preserving, high-integrity behavioral signals: payment consistency, savings discipline, corridor stability, ROSCA performance, merchant fulfillment, dispute history.

Lending arc.

Collateralized credit (BTC-backed lines) with transparent LTV bands, auto-margining, and agentic rebalancing.

Blended credit (BTC plus income/behavior signals),

Partially uncollateralized community-backed credit (pooled guarantees, capped loss rates).

Underwriting engine. On-chain + partner data form risk cohorts; agents optimize limit, tenor, pricing, and payment rails; programmable links automate collections; corridor-aware pricing manages risk.

UBI, redefined. Not handouts—equal access to opportunity, delivered via (1) a stable-currency account, (2) fair credit, and (3) BTC-anchored wealth tools.

Phase III outcome: scalable credit that composes with payments and savings—closing opportunity gaps rather than papering them over.

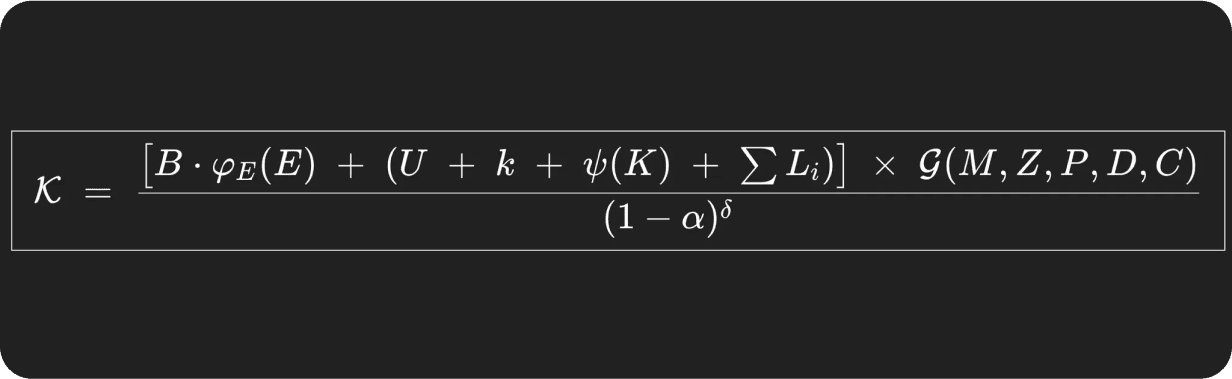

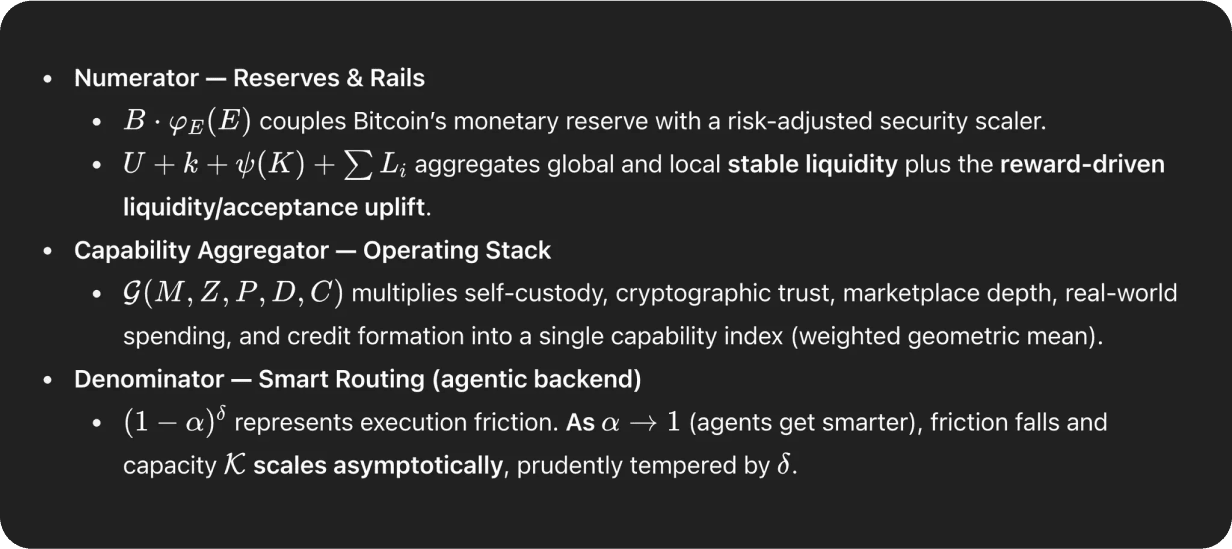

Fundamental Variables that Enable Kontigo’s Vision

Phase I — Smart Self-Custody Wallet Infrastructure (Current Position)

Bitcoin (B)

store-of-value reserve, measured in $-equivalents (Lightning-enabled).

Energy (E)

cumulative proof-of-work securing Bitcoin.

USDC (U)

dollar-denominated unit of account and settlement asset.

USDK (k)

converter that turns inflationary fiat into a stable on-ramp.

Koin (K)

native reward system of the ecosystem.

Local stablecoins (ΣLᵢ)

jurisdiction-specific liquidity pools that deepen reach.

MPC wallets (M)

chain-agnostic, self-custodial key management.

Zero-knowledge proofs (Z)

privacy and trustless validation.

Decentralized on-chain P2P (P)

market layer for instant peer settlement.

Non-custodial debit rails (D)

card infrastructure spending from self-custody.

On-chain credit (C)

collateralized and, over time, partially uncollateralized lending capacity.

Smart routing (α)

0≤α<10 le alpha < 10≤α<1; higher α = smarter agents (lower execution friction).

Functional terms (for clarity in the equation):

System Capacity Formula:

This equation formalizes our thesis: only the combined force of Bitcoin reserves, stable-liquidity instruments (global + local), cryptographic trust layers, agentic routing, and radical UX abstraction can deliver a universal, permissionless, stable-cash system.

Urgency and stability

A thriving global economy is impossible without universal access to a stable unit of account. Credit, investment, insurance—even a meaningful UBI—become viable only after that foundation exists.

Let’s be explicit: while the U.S. dollar remains dominant, it has lost the majority of its purchasing power since 1975; prices are multiple times higher today. That erosion is precisely why billions seek inflation-resilient rails.

As advanced AI proliferates, equitable financial access becomes a stability imperative—not a luxury. Neglecting it risks deeper inequality, weaponized AI, and stagnation.

True economic freedom will not emerge from speculative pumps, memecoins, or endless token launches—and it must reach those outside the developed world, at scale.

Bitcoin must be vertically integrated to fulfill Satoshi’s cash-system vision. Today, it is not. The roadmap above outlines how we bridge the gap—grounded in engineering discipline and focused on the first one billion humans who most urgently need stable-currency infrastructure.

Beyond Earth

By the time we settle Mars, we must avoid at all costs exporting Earth’s monetary and economic failures. A resistant, decentralized, programmable financial system will be the backbone of interplanetary trade.

Our vision is accomplished when we establish a stable-currency economic structure for multiplanetary abundance.

BTW. Competition is for losers.

© 2025 Kontigo, Inc. All rights reserved.

Kontigo, Inc. ('Kontigo') (i) does not provide or offer financial services nor carry out any type of activity typical of financial institutions that require authorization to operate, (ii) does not engage in money-raising activities in accordance with applicable regulations. The digital assets available in the services offered by Kontigo are managed under the user's own custody and are not recognized as legal tender under current regulations. By using Kontigo's services, users expressly acknowledge that they are aware of the particularities associated with them as set forth in the Terms and Conditions available on this website.

These terms and conditions (the “T&C”) shall apply to the use, access, and all other activities related to the mobile applications, products, software, websites, APIs, and other services (together, the “Services”) offered and/or made available in accordance with the regulations of the corresponding country.